Executive Summary

- Economic uncertainty has resulted in an extremely strong year for gold, with the precious metal rallying ~30% as of early September

- As investors look for safe havens, a discussion has emerged about whether cryptocurrency—specifically bitcoin—could become “the new gold”

- While bitcoin has not yet achieved the safe-haven status gold enjoys, with time and continued acceptance, it could come to serve a similar role in financial markets

- There are several similarities between bitcoin and gold, including their scarcity and their role as stores of value. Despite the similarities, however, bitcoin lacks the legitimacy of gold’s 5,000-year history

- TIFF is cautiously optimistic about crypto’s future and has made small investments to capitalize on innovation in the space

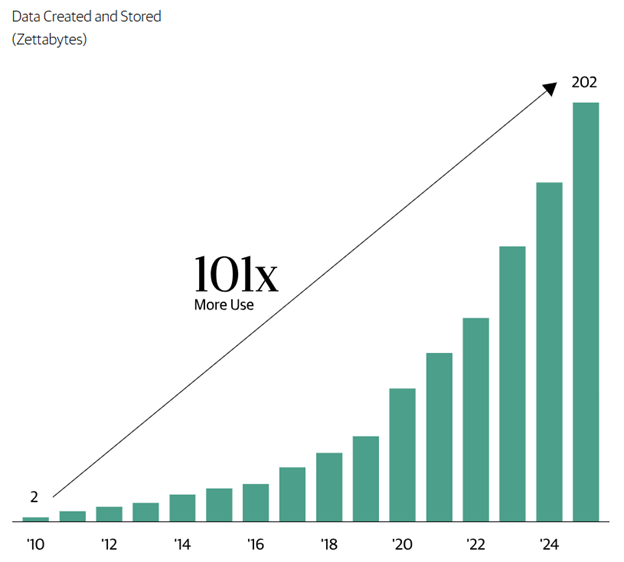

So far, 2025 has been a year of uncertainty. Investors wait anxiously on news of potential tariffs, geopolitical risk remains elevated, and the market swings with each new announcement. It is not surprising, then, that investors are seeking safe havens such as gold. Gold has had a phenomenal year, returning over 30% as of early September. The last time gold saw gains of this magnitude was 15 years ago in 20101. Unlike 2010, however, investors are starting to see another potential safe haven to weather turbulent markets: cryptocurrencies.

It’s important to take a brief step back. Saying that cryptocurrency could be a safe-haven asset is too broad a statement. The crypto universe is incredibly diverse, with different cryptos serving distinct purposes and deriving value in different ways. For example, a stablecoin is different than a utility token. To be more specific, let’s focus primarily on bitcoin. Originally designed to function much like a currency, bitcoin is now the most widely accepted crypto asset, accounting for more than 55% of the total crypto market cap2. Given its primary use case as a store of value and its dominance in the market, we will focus the remainder of this paper on the comparison between gold and bitcoin.

Many have speculated whether bitcoin is or will become the new gold, gradually overtaking the precious metal as the premier safe haven. While it has not yet achieved the safe-haven status that gold enjoys, with time and continued acceptance, bitcoin could come to serve a similar role in financial markets.

Two Sides of the Same Coin

Why has the comparison between these assets been drawn? While there are notable differences between the two, gold and bitcoin share several similarities, beginning with scarcity.

Gold is unique among many major commodities in that it is not typically consumed. While it can be used in items like batteries, producers often substitute other metals due to gold’s high cost. Its supply also grows very slowly. A report from Goldman Sachs states that “new annual production adds just over 1% to the existing stock and is stable and price inelastic.”3 As a result, when demand grows, it is difficult (if not impossible) to quickly increase supply, as producers might with oil, to meet the increase in demand. This constraint ultimately helps drive up gold’s value.

Bitcoin is similar. It has a fixed supply, with the final bitcoin projected to be mined by 2140. In fact, bitcoin’s scarcity is now even greater than gold’s, as measured by its stock-to-flow ratio (the existing supply relative to annual production). In April 2024, bitcoin surpassed gold as the asset with the highest stock-to-flow ratio among liquid and easily tradable assets4.

One of the most important similarities is that both gold and bitcoin function as stores of value, meaning they are expected to preserve their worth over time. This quality is especially important for any asset to be considered a safe-haven. Investors seek assets they believe will protect their wealth during times of uncertainty. Gold acquired this characteristic because it was discovered to be both scarce and durable. Bitcoin, by contrast, was deliberately created as a store of value. Ultimately, however, both rely on shared trust to sustain their worth.

The Test of Time

It is in this need for “buy-in” and belief that we begin to see the key difference between bitcoin and gold. Gold has been considered a source of wealth for 5,000 years. The U.S. once operated under a literal “gold standard,” and even though that ended more than 50 years ago, the term still signifies the highest level of quality. There is no dispute that gold is valuable and will continue to be into the future. Bitcoin, by contrast, lacks that legacy.

This difference is reflected in the respective volatility of the two assets. Gold has a long-term volatility of approximately 15%. Bitcoin’s volatility, meanwhile, has decreased as it has gained greater legitimacy, but over the past five years it has still averaged approximately 40%—more than twice that of public equities. That level of volatility is hardly consistent with what one would expect from an asset used predominantly as a safe haven!

The good news for bitcoin is that it shouldn’t take 5,000 years for it to achieve the same level of legitimacy as gold. Adoption of new technologies and innovations occurs far more quickly now than in the past. As the number of bitcoin investors continues to grow, and if regulation remains favorable, bitcoin may begin to behave more like gold.

There are risks, however, that could change bitcoin’s trajectory. One of the most prominent is the advancement of quantum computing. This poses a significant risk to any digital technology that relies on the difficulty of prime number factorization. In theory, quantum computers can factor huge numbers exponentially faster than classical computers, which could render bitcoin’s mining methods obsolete.

Bitcoin miners and developers are aware of these risks, and upgrades could be implemented to mitigate quantum threats. Another risk is the possibility that a different store-of-value cryptocurrency could eventually supplant bitcoin. As the first cryptocurrency, bitcoin certainly holds a significant edge, but technological advances, regulatory shifts, or investor sentiment could change that.

Positioned for Possibility

Uncertainty notwithstanding, there may be growing validity in the idea that bitcoin is the new gold”—or that it could be in the future. The similarities between gold and bitcoin are evident. What bitcoin still lacks is the confidence in its value that gold has earned over centuries. With time, however, that confidence could still come.

In the interim, we at TIFF still believe it is prudent to have at least a small exposure to crypto in our portfolios. We do this through limited allocations to a relative value crypto strategy, a broad-based liquid crypto index fund, and a crypto-oriented VC strategy. Though the position is small, we believe meaningful innovation will emerge from the crypto ecosystem that ultimately drives genuine value. While we may not yet know what form that value will take, we are confident that when the opportunity becomes clear, we will be well positioned to capture it.

If you have a question about cryptocurrency, gold, or how TIFF can help you manage your portfolio through uncertain times more broadly, please do not hesitate to reach out.

The materials are being provided for informational purposes only and constitute neither an offer to sell nor a solicitation of an offer to buy securities. These materials also do not constitute an offer or advertisement of TIFF’s investment advisory services or investment, legal or tax advice. Opinions expressed herein are those of TIFF and are not a recommendation to buy or sell any securities.

These materials may contain forward-looking statements relating to future events. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” or “continue,” the negative of such terms or other comparable terminology. Although TIFF believes the expectations reflected in the forward-looking statements are reasonable, future results cannot be guaranteed.

Footnotes

Bloomberg Intelligence. “Navigating Crypto Volatility: All Options Considered.” Bloomberg. Published May 6, 2025. Accessed September 17, 2025. https://www.bloomberg.com/professional/insights/markets/navigating-crypto-volatility-all-options-considered/.

CoinGecko. “Global Cryptocurrency Market Cap Charts.” Accessed September 17, 2025. https://www.coingecko.com/en/global_charts.

Goldman Sachs, Precious Analyst Gold Market Primer, August 17, 2025, accessed via Goldman Sachs Marquee.

Bitget Academy, “Understanding the Stock‑to‑Flow Model: Scarcity Drives Value,” Bitget, published April 22, 2025, accessed September 17, 2025. https://www.bitget.com/asia/academy/understanding-stock-to-flow-bitcoin.