Executive Summary

- The hedge fund industry is no stranger to AI, but recent advancements have improved the way hedge funds invest.

- Data is a key competitive advantage for hedge funds leveraging AI. However, investors should understand how that data is sourced, processed, and interpreted.

- Key impediments to broader AI adoption include the high cost of computing power and difficulty attracting top-tier talent.

- Despite AI’s growing role, human judgment remains a critical component of investment decision-making.

Introduction

Leopold Aschenbrenner, a 23-year-old former OpenAI engineer and founder of the $1.5 billion hedge fund Situational Awareness, wrote recently that “Everyone is talking about AI, but few have the faintest glimmer of what is about to hit them.”1

For an industry that hires some of the smartest people in the world and prides itself on innovative investment approaches, how vulnerable is the hedge fund industry to an AI invasion?

In reality, hedge funds have been incorporating forms of AI for decades. Large systematic (quantitative) funds have existed since the 1980s. Even more recent funds like Numerai, which relies on public tournaments to crowdsource quantitative trading signals, have been around for over a decade.2

Let’s explore how hedge funds are deploying AI today, along with the challenges that still exist.

Data and Delusion

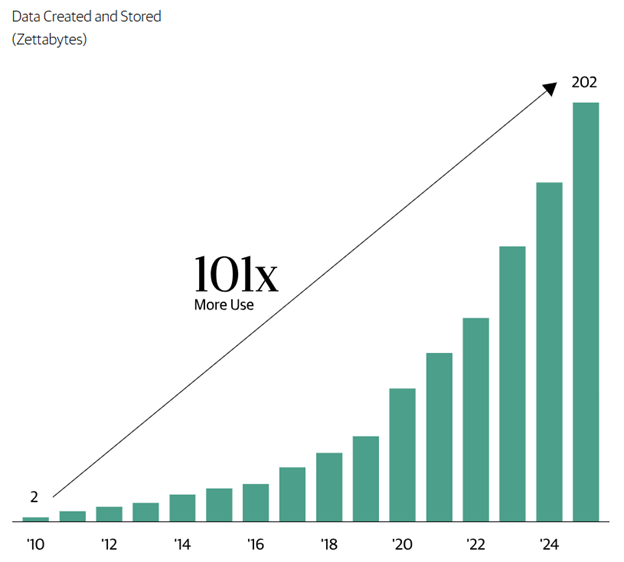

Put simply, AI models take large amounts of data and aim to predict the future of market movements based on this data (Figure 1). Yet we often hear the question: “Isn’t data just data? Can’t everyone just buy the same data?”

Not so. In practice, we have found that access to proprietary, well-structured data has become one of the key differentiators in determining which hedge funds have an edge in the AI race.

Ben Wellington from Two Sigma highlighted this point on a recent podcast, emphasizing the importance of being present at the moment data is created to ensure proper categorization.4 In this podcast, he shared an example from the post-financial crisis era: after 2008, a major newspaper retroactively labeled articles from 2006 and 2007 as “subprime.” A researcher relying only on these labels might mistakenly conclude that the sudden rise in “subprime” mentions was a powerful predictive signal. In reality, it reflected backfill bias—a postmortem reclassification rather than a true early warning.

One area within hedge funds where data aggregation has shown its worth is in the event-driven space. Long-tenured Equity Capital Markets (ECM) funds investing in deals such as IPOs, M&A, and issuances have been able to accumulate a treasure trove of data on past transactions, which in turn helps make surprisingly accurate predictions about outcomes of future events.

For example, by identifying situations that are likely to lead to a deal break, an M&A fund could limit its exposure to left-tail events, thereby enhancing its overall return profile of the fund.

Moving forward, we believe those funds with the deepest, richest, and most proprietary data will retain a significant edge. More recent entrants will need to demonstrate more creativity in how they use available data to leapfrog incumbents.

Talent and Technology

Nvidia’s staggering ~1,200% performance5 over the past five years has demonstrated the importance of computing power to AI development. More processing power means faster hypothesis testing and portfolio optimization which may lead to faster and better signal development. For systematic funds, this could translate directly into alpha. The downside is that processing power is expensive and difficult to scale. Leasing costs for data centers for a large systematic fund can run into hundreds of millions of dollars per year, thus limiting the amount of AI a smaller hedge fund can realistically deploy.

More important than processing costs is the ability to attract talent. It is often said that 20% of researchers generate 80% of the successful signals in a given year, though the challenge is that no one knows in advance which 20%. For this reason, it is important to keep a wide cast of highly talented (and highly paid) staff on the payroll. Hedge funds are competing with technology firms for top AI talent, with pay packages now exceeding $1 million per year. What’s more, each AI developer needs to have a supporting cast of data engineers and developers to help turn theory into reality.

That said, we have seen increasing success rate among more entrepreneurial managers who strike out on their own with assistance from AI, particularly those focused on a specific niche.

Judgement and Justification

For all of AI’s capabilities, there remain areas of investing where human judgment is difficult to replicate. Manager discretion is one of the most significant. Fundamental strategies retain an edge in situations where decision-making depends on conviction, contrarian thinking, or nuanced human interactions. For example, when a portfolio manager chooses to concentrate on a handful of high-conviction positions, or makes a contrarian trade based on direct engagement with company management, the driver is individual judgment rather than an algorithmic signal.

Management meetings underscore this distinction. Whether investors are receptively learning or seeking to influence outcomes through activism, these activities remain firmly in the fundamental toolkit, not the quantitative one. Human relationships and qualitative assessments are central to investment due diligence, and AI has not yet shown an ability to replicate these dynamics. Many of the top-performing fundamental hedge funds demonstrate a proclivity to execute judgment calls that may rest on nothing more than pattern recognition honed over years of experience in a particular market segment.

This is not to say AI cannot aid the traditional investment process. We often find that today’s fundamental investors are using AI to help them summarize information and build a baseline understanding. Tools capable of reading decades of company filings in minutes, updating financial models post earnings in seconds, and distilling real-time company news into bullet points have given these managers much greater efficiency in their decision-making.

Conclusion

We remain optimistic about AI’s potential and believe it will continue to reshape the landscape of the hedge fund industry. However, managers should be cautious not to rely so heavily on AI that they lose their judgment.

The materials are being provided for informational purposes only and constitute neither an offer to sell nor a solicitation of an offer to buy securities. These materials also do not constitute an offer or advertisement of TIFF’s investment advisory services or investment, legal or tax advice. Opinions expressed herein are those of TIFF and are not a recommendation to buy or sell any securities.

These materials may contain forward-looking statements relating to future events. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” or “continue,” the negative of such terms or other comparable terminology. Although TIFF believes the expectations reflected in the forward-looking statements are reasonable, future results cannot be guaranteed.

Footnotes

Leopold Aschenbrenner, Situational Awareness: The Decade Ahead, 2025. https://situational-awareness.ai/introduction

Justina Lee, “JPMorgan Pledges $500 Million to Crowdsourcing Hedge Fund Numerai,” Bloomberg, April 16, 2024. https://www.bloomberg.com/news/articles/2024-04-16/jpmorgan-pledges-500-million-to-crowdsourcing-hedge-fund-numerai

Blackstone, Cutting Through the Noise: The Long-Term Case for Data Centers, The Connection, 2024. https://www.blackstone.com/the-long-term-case-for-data-centers

“Ben Wellington: ML for Finance, NYC Open Data, and Communicating with Maps,” The Gradient: Perspectives on AI, Apple Podcasts, January 10, 2024. https://podcasts.apple.com/us/podcast/ben-wellington-ml-for-finance-and-storytelling/id1569777340?i=1000649209968

Kif Leswing, “Nvidia Hits $3 Trillion Market Cap on Back of AI Boom,” CNBC, June 5, 2024. https://www.cnbc.com/2024/06/05/nvidia-briefly-passes-3-trillion-market-cap-on-back-of-ai-boom.html