Executive Summary

- Total Portfolio Approach (TPA) has become a focal point of portfolio construction discussions, as large institutional investors have recently adopted it.

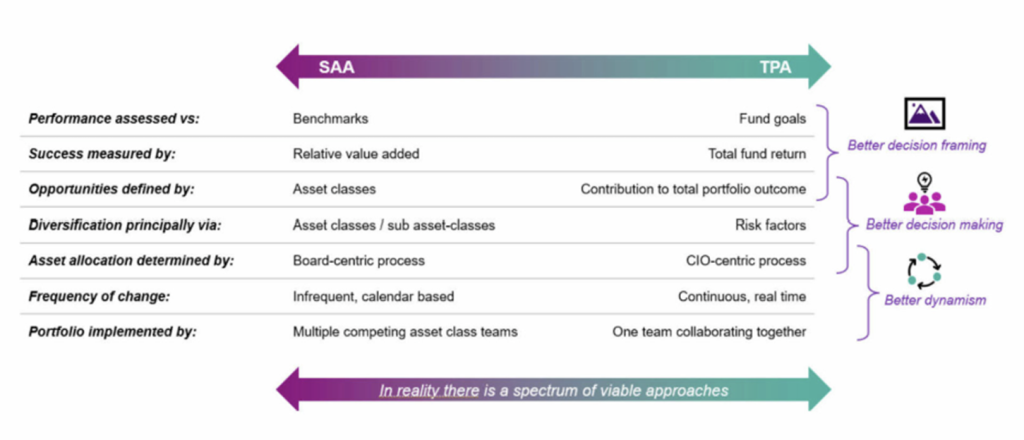

- TPA advocates for a portfolio to be managed as a whole, setting a portfolio-level risk budget and allocating across the best ideas within any asset classes.

- This contrasts with a traditional Strategic Asset Allocation approach, which sets asset-class targets based on long-term return expectations and allocates within each asset class to achieve the target.

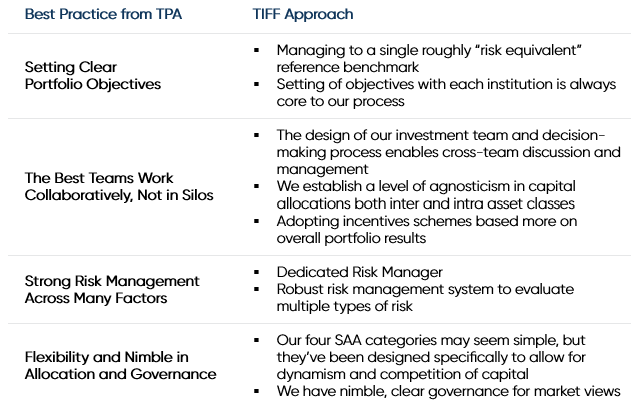

- While TPA has become the new darling of portfolio construction discussions, TIFF believes that TPA’s core tenets are just best practices of a robust investment program. Those tenets include the use of clear objectives and the incorporation of multiple risk factors in one’s allocation assessment.

- There are practical limitations of implementing TPA, too, such as the increased reliance on factor modeling, the flexibility (or inflexibility) of illiquid positions, and the need to shift decision-making towards the CIO.

- TIFF believes its investment process incorporates the best elements of both SAA and TPA: allocating capital based on clear objectives and the best marginal idea to the portfolio, grounded on today’s best information, with a long-term eye towards expected returns.

Where does TIFF stand on The Total Portfolio Approach?

There are always new and evolving ideas on portfolio construction theory. While Total Portfolio Approach (TPA) has been around for decades, it has been gaining increased exposure in the U.S., particularly since the California Public Employees’ Retirement System (CalPERS) — a pension fund behemoth controlling $600+ billion1 in assets — announced it will be implementing TPA effective July 1, 2026. Several high-profile, international mega-institutions, including Canada’s Pension Plan Investment Board, Singapore’s GIC, and Australia’s Future Fund, have espoused TPA as a more modern, flexible, and risk-aware way to manage complex portfolios than Strategic Asset Allocation (SAA).

However, many of the core beliefs of TPA are familiar to CIOs and capital allocators. TIFF believes that TPA’s core tenets are simply best practices of a robust investment program. At the same time, there are certain practical limitations of implementing TPA (and eliminating any SAA elements). In the process of examining the real-world pros and cons of TPA, TIFF discovered our program is already implementing the best elements of TPA, while maintaining a long-term eye on capital allocation through the SAA framework.

What is the Total Portfolio Approach?

TPA advocates for managing a portfolio as a single, integrated whole, rather than as a collection of independent asset-class sleeves. It reframes the allocation process so that capital and risk are allocated simultaneously against total portfolio objectives, or a single reference portfolio benchmark.

In practice, this often includes:

- Portfolio Objective & Risk Budget: Setting total portfolio objectives and a single portfolio reference benchmark (e.g., 65/35 MSCI ACWI/Bloomberg Aggregate).

- Unified Risk Management: Managing risk across the entire portfolio, using a single risk budget and considering various risk types (drawdown, liquidity, etc.) holistically.

- Factor-Based Investing: Focusing on broad economic factors (like inflation, geopolitics, climate) and their impact on returns, allowing for better positioning against future shocks, instead of just asset class dynamics.

- Marginal Portfolio Contribution / Competition for Capital: Evaluating investments based on their impact on total portfolio risk (“there are no buckets”) vs. how they fit within their own asset class portfolio and perform relative to asset class benchmarks.

- Dynamic Reallocation: Having the ability to dynamically shift investments to areas with the best risk-adjusted returns, not marginal asset class shifts each year.

Framework Comparison of TPA to SAA – A Spectrum of Implementation Approaches

TIFF’s Perspective: Useful Reminder of Best Practices, Not Revolutionary

TIFF’s view is that total portfolio thinking is fundamentally sound, but not new. Managing risk and capital at the portfolio level is simply good investment practice. In fact, experienced, top-tier investment teams have long considered cross-asset interactions, liquidity constraints, and marginal risk contributions when building portfolios, even if they did not label the process “TPA.”

TPA is a good reminder of portfolio construction best practices, regardless of title. When examining the real-world practices and implementation of TPA, TIFF found the best elements of TPA are already incorporated into our approach.

Limitations of TPA

In theory, TPA aims to be more dynamic and risk-aware than traditional SAA, but in practice it relies on a number of assumptions that don’t always hold up in real-world investing. These include: stable factor relationships, the ability to anticipate changes in volatility (timing the market), and the idea that illiquid positions can be managed with the same flexibility as liquid ones. Most large asset owners eventually find that the approach pushes decision-making away from true investment judgment and toward highly modeled, factor-driven processes that can look precise but are fragile in the face of regime shifts.

We also worry that approaches built around volatility-targeting or factor-optimization can inadvertently constrain returns or lead to many small “wins” followed by occasional large drawdowns, a pattern we’ve seen before in model-heavy frameworks.

Conclusion

The hype over the Total Portfolio Approach offers an important reminder: portfolios should be managed as integrated wholes, not as disconnected parts. TIFF agrees with this principle and practices it in substance. However, we remain skeptical of claims that TPA represents a fundamentally new or superior model that, on its own, delivers better performance.

In our view, TPA is best understood as common sense applied consistently, supported by strong governance, clear objectives, and experienced judgment. When used thoughtfully and pragmatically, total portfolio thinking can enhance decision-making. When treated as a cure-all or a rebranding exercise, it risks overselling what ultimately remains the same timeless challenge—building resilient portfolios that can meet long-term objectives across a wide range of market environments.

Past performance is no guarantee of future results and the opinions presented cannot be viewed as an indicator of future performance. There is no guarantee that any particular asset allocation or mix of strategies will meet your investment objectives.

The materials are being provided for informational purposes only and constitute neither an offer to sell nor a solicitation of an offer to buy securities. These materials also do not constitute investment, legal or tax advice. Opinions expressed herein are those of TIFF and are not a recommendation to buy or sell any securities.

These materials may contain forward-looking statements relating to future events. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” or “continue,” the negative of such terms or other comparable terminology. Although TIFF believes the expectations reflected in the forward-looking statements are reasonable, future results cannot be guaranteed.

Footnotes

https://www.calpers.ca.gov/investments as of January 13, 2026.