Executive Summary

- 2026 is “game time.” The year ahead should help answer whether the One Big Beautiful Bill (OBBB) supports growth and disinflation, whether deficits can be reined in, and whether the AI boom is durable—or a bubble.

- OBBB could be a net positive for growth and possibly inflation. We expect tax cuts and investment incentives to support jobs and productivity, potentially keeping inflation contained and giving the Fed room to ease.

- The budget deficit remains the biggest long-rate risk. With U.S. debt cited at approximately $38.4T by year-end 2025 and still rising, we remain cautious on long duration and mindful of dollar risk.

- Tariffs may change form, but the peak shock has likely passed. Even if current tariffs are overturned and later re-implemented under different authorities, we expect the worst of the tariff impulse is behind us.

- AI remains in the middle innings, but scrutiny is rising. Hyperscalers’ 2026 capex is cited at approximately $550–$600B and potentially much more in aggregate, meaning markets will increasingly demand proof of broad adoption and real returns.

- Outlook and positioning remain constructive, with more volatility. We expect a more two-sided equity market with bigger swings and mid-single-digit gains as a base case, while staying fully invested and close to policy targets. We are modestly overweight healthcare, roughly market weight “Mag 7,” short fixed-income duration, with a slight underweight to the U.S. dollar.

Game Time

Happy New Year! At least that is our hope as we turn the calendar to 2026. While we are optimistic, we are not certain that capital markets will maintain the same excellent streak they’ve enjoyed since 2022. The year ahead may be when we find out if the administrations’ One Big Beautiful Bill (OBBB) actually helps the economy and brings down inflation (we still believe it can), whether U.S. budget deficits can be reined in relative to GDP growth (we doubt it), and finally whether markets are in an AI bubble or if AI can justify all the “pre-game” hype (we are cautiously optimistic).

Because the OBBB cuts taxes for both households and businesses and provides more generous investment incentives, we remain optimistic about prospects for the U.S. economy. Arthur Laffer once asked, “If I tax you 100%, would you work more? If I eliminated your taxes and let you keep everything you make, would you work more?” Everyone in the room agreed that this was not a realistic choice, but that if it was, they would work more if they got to keep more.

We are hopeful that people still feel this way and that the economy will have more people working and more investment supporting these additional jobs. In particular, it would be nice if by exempting taxes on tips and certain overtime, combined with certain child- and work-related credits, the OBBB could help reduce pay inequality. Naysayers don’t bother us; in today’s world, it seems no program can please all of the people. We remain optimistic about the OBBB.

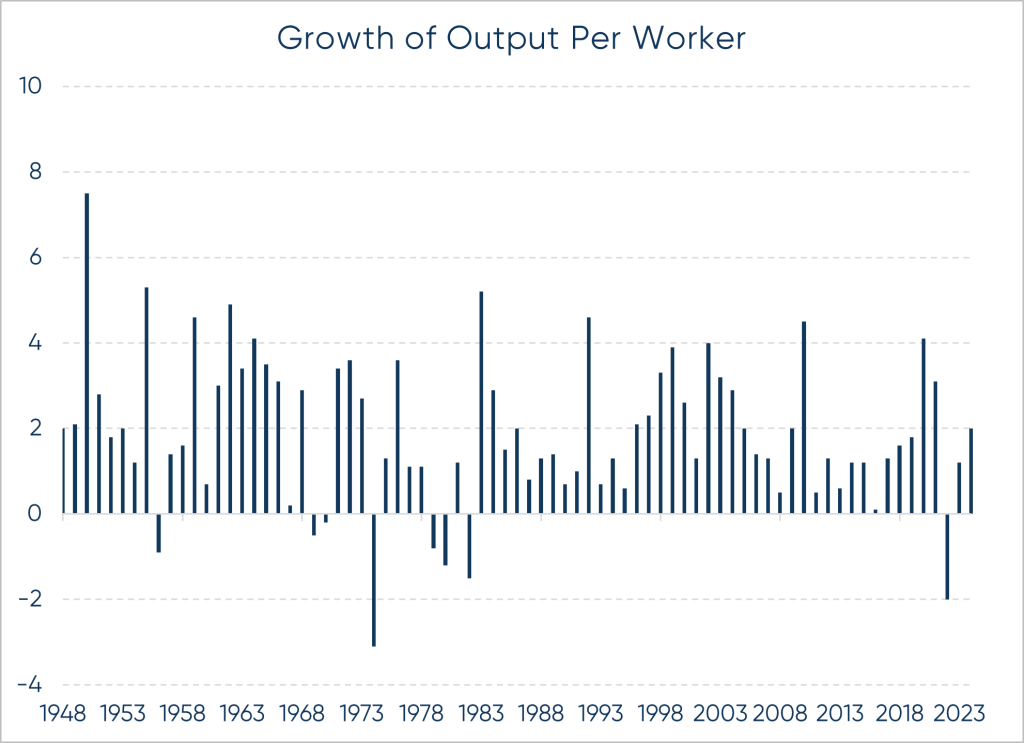

If the economy does remain solid—or accelerate some as the previous paragraph optimistically intimates—it is possible that inflation stays tame. As Milton Friedman famously said, “inflation is always and everywhere a monetary phenomenon.” Translated: it is too much money chasing too few goods. By stimulating investment and jobs, productivity can rise, and the supply of goods hopefully grow at least as quickly as demand. This is a balancing act that could result in stable or even slightly lower inflation levels, which would allow the Fed to reduce short-term rates some. Additionally, and importantly, just as the internet build-out led to higher productivity in the late 1990s and early 2000s period, AI has similar potential to similarly increase productivity.

Prospects for a New Productivity Upswing: Evidence from Historical Periods1

As we write, markets are anticipating the Fed to cut short-term rates by 25 basis points two more times by September 2026. Normally, when the Fed reduces short-term rates, mortgage rates and other borrowing costs fall as well, stimulating further economic growth. Our fingers are crossed that this benign environment can eventuate as it would likely not just be good for short-term interest rates and the economy, but also for the bond and equity markets.

The Setup: Deficits, Tariffs, and Inflation

Much of what we hear on tariffs is that they are likely to be over-turned ruled by the U.S. Supreme Court. It isn’t clear whether the government would be required to provide refunds, but tariffs are unlikely to be allowed as structured today. We fully expect the administration to implement a revised version of tariffs under a new executive order, using different emergency powers or trade acts. Regardless, we expect that we’ve seen the worst of the tariff and that is a good thing. With that policy backdrop, the key market question is what all of this means for inflation and interest rates.

In general, bonds are pretty simple. If a three-month Treasury bill yields 4% and rates are not expected to decline, then a six-month T-bill will typically yield a little more than 4% due to the slightly longer duration. The same principle applies to a 12-month T-bill relative to a 6-month and extends all the way to the 30-year Treasury bond. When investors expect rates to rise or fall based on expected changes in future inflation, the shape of the yield curve can change. Lower rate expectations typically bring the entire interest rate curve lower and vice versa.

So, the yield curve is mostly math plus expectations, which brings us to our biggest concern about long-term rates today: how much debt the U.S. will issue, and what investors will demand to finance it.

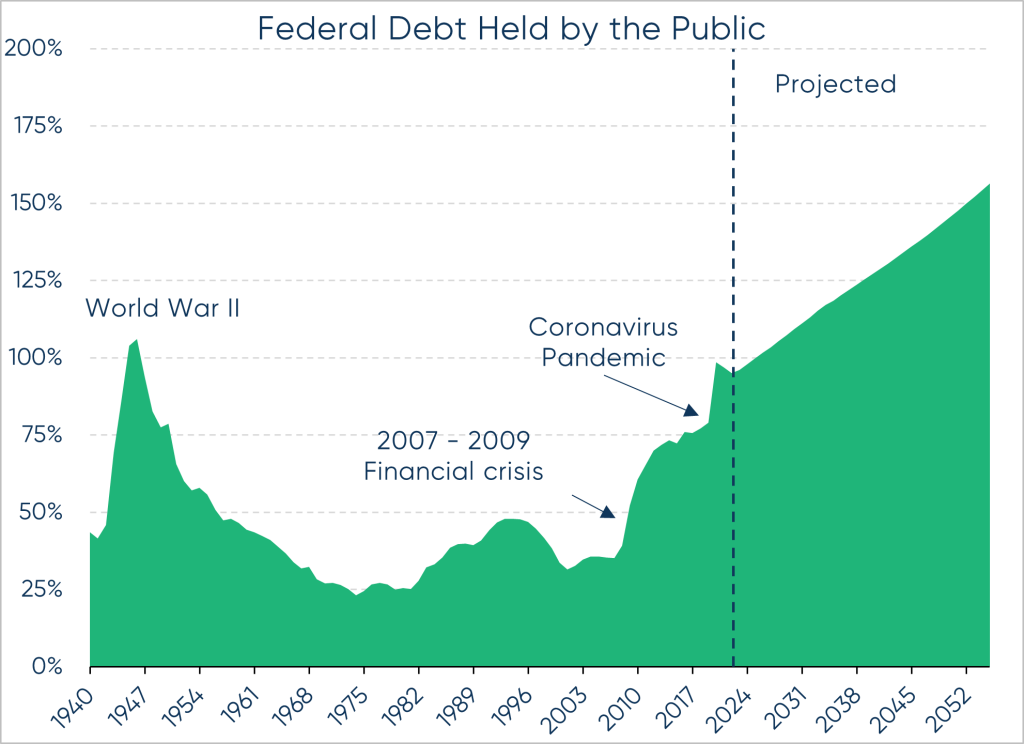

The massive pile of U.S. debt continues to grow, reaching $38.4 trillion by year-end 2025. According to the Congressional Budget Office (CBO), debt growth of $1.9 trillion in 2025 will accelerate to $2.6 trillion by 2035, with total debt expected to reach $138 trillion by 2055. At the current pace, we are expected to add $100 trillion in debt in the next 30 years. This level is expected to equal an estimated 156% of GDP in 2055, up from approximately 100% today! In our minds, this is not sustainable.

This also explains why markets are nervous about U.S. dollar risk. Historically, rather than make the hard decisions about how to balance a country’s budget, politicians have taken the “easy” path—inflating their way out. Devaluing the currency hurts everyone, but bondholders get hurt the worst as they are repaid in less valuable currency than expected. This simple fact keeps us nervous about letting our duration get too long. We remain cautiously positioned today at 4.25 years versus roughly 6.10 years for the Bloomberg Aggregate Index.

All this said, any progress on lowering inflation would be good for bond prices, and if the OBBB were to help bring some balance to government financing, it could lead to lower interest rates than we currently expect. The reasonably low starting interest rate of 4.1% on the 10-year Treasury, however, causes us to believe that even in that environment, extending duration is unlikely to prove helpful for future returns. As we’ve said before, if/as rates move higher, we would be inclined to extend our duration marginally.

The Deficit is Rising Higher and More Quickly than Ever Before2

Another factor shaping the longer-term outlook for inflation and interest rates is the scale of investment our trading partners have proposed in the U.S. Many of these commitments may take years to materialize—if they materialize at all—but those that do could influence growth, inflation, and capital demand well beyond this administration.

A meaningful share of this spending is likely to support the physical build-out required to stay competitive in AI. Leadership in AI will require far greater power generation and grid capacity. Current estimates suggest that roughly $1.1 trillion will need to be invested by 2029 to meet projected AI-driven electricity demand of 123 gigawatts by 2035, up from 4 gigawatts in 2024. Progress on permitting and regulatory reform—also promised in the OBBB—will be critical to enabling this build-out.

AI: Middle Innings or Bubble?

Our optimistic equity outlook has served us well over the past three years. As we enter 2026, we remain constructive, but with greater caution. We expect a more two-sided stock market, with larger swings both up and down, ultimately pointing to mid-single-digit gains. That said, outcomes could deviate meaningfully: a strong or weak finish could shift returns by 20% in either direction, or we could simply be wrong in our assessment. Let us explain.

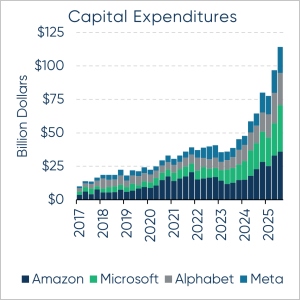

The late-2022 announcement of ChatGPT may have been the catalyst for the 2023 advance and has continued to power markets since. Elon Musk recently claimed that in 10-20 years, work will be optional, like growing your own vegetables is today. Not mandatory, but a choice. He believes AI and robotics will create an “age of abundance” in which goods and services become nearly free. While this may or may not prove true, it has investors thinking that the rewards of backing the right companies could produce huge profits in the stock market. The largest and most profitable companies in the world are now spending more on building out datacenters and AI capabilities than would have been imaginable just three years ago. Each company views winning in the AI race as existential.

Something similar happened 30 years ago when the internet captured investors’ imaginations. A group of tech companies spent heavily to build out the internet. It ended up producing enormous benefits for society, but also a bubble in stock market values that later collapsed. The leading stock at the time, Cisco Systems, rose to $82 per share in March 2000 from $0.14 in January 1991. While Cisco has been a successful company over the last 25 years, it has yet to reclaim its 2000 high.

This concern exists today for some of the leading AI companies. After three years of strong gains, we expect to glean some clarity in 2026 on whether or not this technology and these companies are real and can change the world, or whether this is another bubble similar to the internet boom. We expect more back and forth in 2026 than we’ve seen to this point.

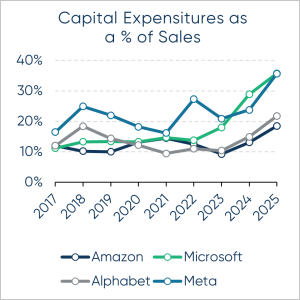

Mag 7 valuations are elevated and have pulled overall market valuations higher. Strong earnings growth has thus far justified the premium, with expectations for continued growth into 2026. As long as these companies deliver, both they and the broader market can keep moving higher. The risk, of course, is that growth slows. High valuations, paired with moderating earnings and significant capital spending, would represent a headwind for both the group and the broader market.

At some point, that scenario is likely, but we believe we are still in the middle innings of the AI cycle, not the later ones. Ultimately, AI has the potential to become ubiquitous in cars, robots, and beyond. If GDP is a function of the size of the workforce multiplied by productivity, and robots can increasingly perform human tasks, then GDP growth could rise well beyond current limits. Such an outcome could usher in an age of abundance marked by stronger growth and lower inflation.

That doesn’t mean stocks will go straight up. We expect this year will be more two-sided, with the bull argument and the bear argument each dominating at different times. All the talk about what AI can and will do will be more carefully scrutinized by investors. The massive sums of capital being invested will need to produce returns to justify further investment. Without justification, investors may move to the sidelines, and the stocks could decline. Capex projections for hyperscalers in 2026 are approximately $550-600 billion. Including other participants, capex could reach as much as $2 trillion by some estimates. Without signs of broader adoption across corporate America and beyond, this level of spending will likely trigger a retrenchment in stock prices.

Balancing Elevated Valuations with Record Capital Spending3

It’s hard to be certain how the year may unfold, but we do believe one side of this debate may be in vogue for a time, only to be replaced by the other later in the year. This dynamic could repeat more than once. When we get to the end of the year, we don’t think it will be “decided”, but we do think we will be closer to understanding whether AI is a bubble or possibly the most important development of our lives.

Regardless, we start 2026 with very high valuations and expect that downside moves could be larger than we’ve seen in a few years. We are also aware that the last three years have been particularly strong, producing three-year compound SPX returns north of 20%. The last periods with comparable returns were 2021 and 1999, which were both followed by bad equity markets in 2022 and 2000. This doesn’t mean stocks will fall but does remind us that if fundamentals do change, markets have come a long way and could retrace some of those gains. In the end, modest inflation, an easing Fed, a resilient consumer, and expected low-double-digit earnings growth cause us to believe that when we ring in 2027, we will be capping another positive year—though possibly one that requires some hand wringing along the way.

Finally, on this subject, we regularly remind ourselves that markets are rational, even if investors sometimes are not. The market looks forward and discounts earnings back to a current value of expected future earnings discounted back at an appropriate risk-adjusted rate. High current valuations are not a reason to sell stocks, but they are a good indication that if expectations are not met, the potential downside may be larger than average. As long as the future continues to get brighter, stocks can continue to rise.

The more investors doubt that stocks can rise, the more cash on the sidelines waiting for a pullback. If stocks don’t pull back, then one by one those sidelined investors re-enter the market and push prices higher. Once everyone (proverbially) is fully invested and conditions change, that is when the market peaks and begins its decline. This is what makes calling tops so difficult.

As we move through 2026, we won’t be trying to call a top per se, but we do hope to rebalance out of winners and into underperformers, and vice versa, at appropriate times. Rebalancing and dollar cost averaging are your friends. We try not to forget that.

Today’s Positioning

Today we remain fully invested and broadly aligned with our strategic asset allocation targets for our client portfolios. We are not taking any meaningful geographic over- or underweights versus well-known indices. Within equities, we hold a modest overweight to healthcare—a sector that has lagged in recent years but one we believe could benefit from AI adoption. We also think RFK-related concerns have largely peaked, creating room for valuations to improve. Our position in the Mag 7 is roughly market weight; these companies continue to generate substantial cash flow to fund future investment, and in our view, at least one or two are likely to be long-term winners if AI unfolds as expected.

In fixed income, we continue to run short duration and maintain a slight underweight to the U.S. dollar, given our fiscal concerns. Our hedge fund portfolios are again expected to provide better returns with similar or better ballast than fixed income.

2025 was another good year for markets—the third in a row. Here’s to a solid 2026 as well, even if we expect a bumpier path and a few more lead changes along the way.

As always, we greatly appreciate the opportunity to manage your capital and help you achieve your organization’s goals. We are here to assist so please feel free to reach out with any questions or needs.

Your TIFF Investment Team

Past performance is no guarantee of future results and the opinions presented cannot be viewed as an indicator of future performance. There is no guarantee that any particular asset allocation or mix of strategies will meet your investment objectives.

The materials are being provided for informational purposes only and constitute neither an offer to sell nor a solicitation of an offer to buy securities. These materials also do not constitute investment, legal or tax advice. Opinions expressed herein are those of TIFF and are not a recommendation to buy or sell any securities.

These materials may contain forward-looking statements relating to future events. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” or “continue,” the negative of such terms or other comparable terminology. Although TIFF believes the expectations reflected in the forward-looking statements are reasonable, future results cannot be guaranteed.

Footnotes

Federal Reserve Bank of San Francisco, data on growth of output per worker.

Congressional Budget Office, federal debt projections.

Company disclosures and Wall Street Journal reporting.