Executive Summary

- U.S. exceptionalism remains intact: We continue to see the U.S. as the world’s economic leader and believe equities remain the most resilient long-term store of value. We are mildly underweight bonds (both notional and duration-adjusted) given fiscal concerns.

- What other markets teach us: Argentina and Turkey’s stellar local-currency returns are not signs of economic health; currency depreciation tells the fuller story. When translated to USD, their markets no longer outpace the U.S./ACWI, yet equities there still delivered positive real-asset exposure through turmoil.

- Deficits and dollar risk warrant attention: The U.S. must sell roughly $2T of new debt each year. If foreign demand wanes, rates could rise and the dollar could weaken. That would slightly reduce the appeal of U.S. stocks for foreign buyers and could pressure bonds.

- Practical safeguards: Sensible steps include reviewing dollar exposure, maintaining global diversification, and holding proven real-asset hedges like gold; bitcoin may also play a limited role for some. Even so, owning equity remains the most universal hedge against inflation and currency decay.

- Current positioning: After ~30% gains from April lows, we are at target equity exposure and carry modest equity puts as inexpensive insurance into typical September–October chop.

U.S. Exceptionalism, Risks, and the Case for Equities

Despite unsettling headlines, we believe United States exceptionalism endures. As we wrote last quarter, we believe the U.S. will remain the economic leader of the world for the foreseeable future and that leadership will continue to translate into strong long-term returns. While U.S. fiscal deficits and potential pressure on the dollar deserve attention, and those concerns cause us to be mildly underweight bonds (on both a notional and duration-adjusted basis), we still see equities as an effective and resilient long-term store of value.

Lessons from Abroad

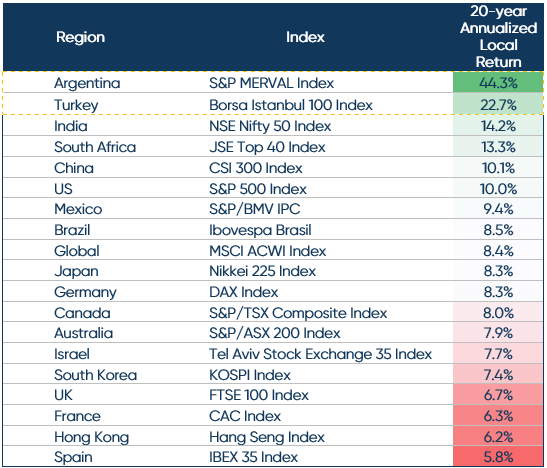

Below is a table of the best-performing stock market indices over the past 20 years, with returns denominated in local currency. For comparison, we have also included the S&P 500 and the MSCI All Country World index (both denominated in U.S. dollars). As shown in the table below, ACWI and the SPX have produced compound returns over that stretch of 8.4% and 10.0%, respectively, which is better than most investors expect going forward.

Net Total Return Local Index (Net of Dividends) Ended July 31, 2025

The two top-performing markets on this chart, Argentina and Turkey, have significantly outperformed the global and U.S. benchmarks, but their story is not one of economic strength.

Argentina’s experience is instructive. Chronic fiscal deficits, runaway inflation, and repeated currency crises drove the peso from roughly 3 per U.S. dollar to roughly 1,400 to 1! Over the past 20 years, living standards have fallen sharply, savings have been destroyed, and confidence in the currency has evaporated. In recent years, the peso lost nearly all credibility as a store of value, with many Argentines preferring to transact in U.S. dollars or other hard currencies whenever possible. This cycle of crisis and inflation repeated multiple times over two decades, preventing lasting stability and demonstrating the importance of strong fiscal and monetary institutions for currency stability.

The U.S. Dollar and Deficit Risk

However, the U.S. is not Argentina. Our institutions are stronger, our economy far more dynamic, our currency is still the world’s reserve, and most major commodities are transacted predominantly in U.S. dollars. That said, persistent deficits create risks. The U.S. government must sell roughly $2 trillion in new debt each year. If foreign demand weakens, higher interest rates and downward pressure on the dollar could follow—reducing the appeal of U.S. debt and eroding purchasing power for bondholders.

The chart below shows the long-term trend of the U.S. dollar (with DXY measuring its general international value by averaging its exchange rates against major world currencies). Today the dollar sits near its long-term average value versus major peers, suggesting to us that the U.S. dollar is somewhere near fairly valued. Confidence remains solid, but fiscal discipline will matter.

We are concerned that if the fiscal situation is not addressed, three impacts may follow. First, the U.S. dollar could depreciate, which would imply that we, as global investors, should increase our international holdings—a step we have not taken to date. Second, the U.S. stock market could become marginally less attractive as foreign investors worry about stock market gains being offset by currency losses. Finally, bonds could sell off, in some cases materially.

Ways to Try and Safeguard Your Capital

Investors do have potential shelters to turn to. Throughout history, investors have looked to real assets when currencies waver. Gold, for example, has risen nearly ninefold over the past 20 years, roughly matching the performance of U.S. stocks. Bitcoin, though newer and more volatile, has also gained some acceptance as a store of value outside government control.

While we believe modest portfolio adjustments, such as examining dollar exposure, maintaining a global portfolio, and owning “safe havens” like gold and bitcoin as a hedge against possible dollar depreciation may be beneficial, we still view equities as the most practical and universal hedge. Investing in stocks may be the simplest way to hedge against inflation, however, because stocks offer exposure to real economic growth, pricing power, and global demand. They allow holders to participate in the hard work and innovation of employees and to benefit from the pricing power that companies can exercise.

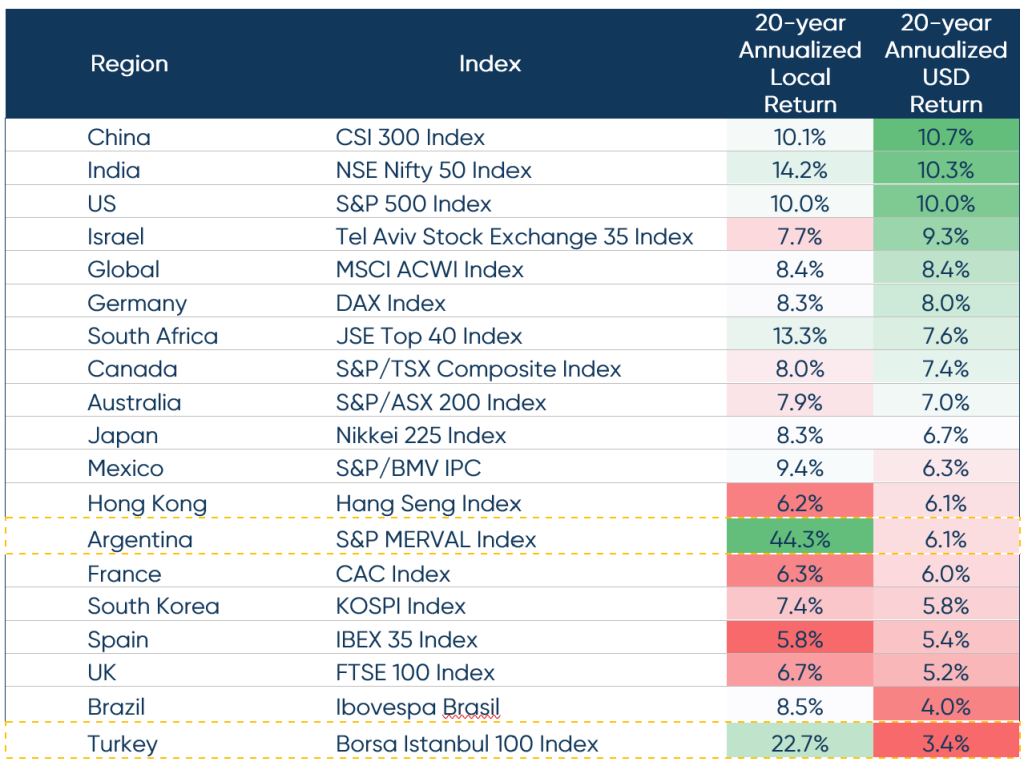

The same chart from above, with returns adjusted into U.S. dollars (see below), shows Argentine and Turkish stocks no longer exceeding the U.S. or ACWI. Yet even these countries’ economically challenged markets have delivered positive returns in the face of massive uncertainty. Unlike bonds, which can be eroded by inflation and currency depreciation, equities have shown resilience—even in countries facing deep crises. And global investors tend to reprice companies toward fair value, creating a natural hedge against local currency weakness.

Net Total Return Index (Net of Dividends) Ended July 31, 2025

This is not to suggest that buying stocks in markets with depreciating currencies is the first choice of global investors. Other risks—such as political stability, capital controls and other governmental intervention—can cause large swings in realized returns over certain periods. It does suggest, however, that if it is possible to make money in equities in Argentina and Turkey in both local and U.S. dollar terms, then it certainly is possible to remain confident even when some pundits claim America has lost it exceptionalism or that foreigners may no longer want to own U.S. assets the way they once did. Stocks are still the asset we consider the most resilient and reliable generators of superior long-term real returns. And we fully expect the United States to maintain the conditions for companies to flourish here.

Our Positioning Today

Markets have been very kind for the past four months, gaining 30% from April’s lows. While we remain constructive and fully at target equity exposure generally, we are mindful of seasonal volatility and policy uncertainty. Historically, if something is going to go wrong, it tends to happen in September or October. As a result, we hold modest equity puts as inexpensive insurance.

Looking beyond the near term, we see supportive conditions for equities. November and December have historically been the strongest back-to-back months of the year. A combination of “revolutionary” new technology (AI), a decent economy, and an easing Fed could be a terrific recipe for higher stock prices.

Closing Thoughts

We remain confident in the United States’ global leadership position, cautious on government debt (including that of the United States), and constructive on equities as the most reliable source of long-term real returns. Deficits and dollar risks should not be ignored, but history and evidence suggest that owning businesses—through equities—remains the best way to preserve and grow wealth over time.

As always, we greatly appreciate the opportunity to manage your capital and help you achieve your organization’s goals. We are here to assist in any way possible, so please feel free to reach out to us with any questions or needs.

Your TIFF Investment Team

The materials are being provided for informational purposes only and constitute neither an offer to sell nor a solicitation of an offer to buy securities. These materials also do not constitute an offer or advertisement of TIFF’s investment advisory services or investment, legal or tax advice. Opinions expressed herein are those of TIFF and are not a recommendation to buy or sell any securities.

These materials may contain forward-looking statements relating to future events. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” or “continue,” the negative of such terms or other comparable terminology. Although TIFF believes the expectations reflected in the forward-looking statements are reasonable, future results cannot be guaranteed.